Not known Facts About Offshore Company Formation

Table of ContentsOffshore Company Formation - QuestionsThe smart Trick of Offshore Company Formation That Nobody is DiscussingFacts About Offshore Company Formation UncoveredThe 10-Second Trick For Offshore Company Formation

Our team can assist with all aspects of establishing an overseas organization in the UAE, consisting of the management and also called for documentation. In order to aid our customers attain the most effective end results, we additionally supply recurring business solutions. This assists make certain business administration satisfies local regulations following first facility. One more element of being able to successfully protect your possessions as well as manage your wide range is of training course choosing the appropriate savings account.

Establishing an offshore company can appear like an overwhelming possibility and that's where we can be found in. We'll direct you through the phases of business development. We're likewise happy to communicate with the necessary authorities and organisations on your part, to make certain the whole process is as smooth as well as smooth as possible.

The smart Trick of Offshore Company Formation That Nobody is Discussing

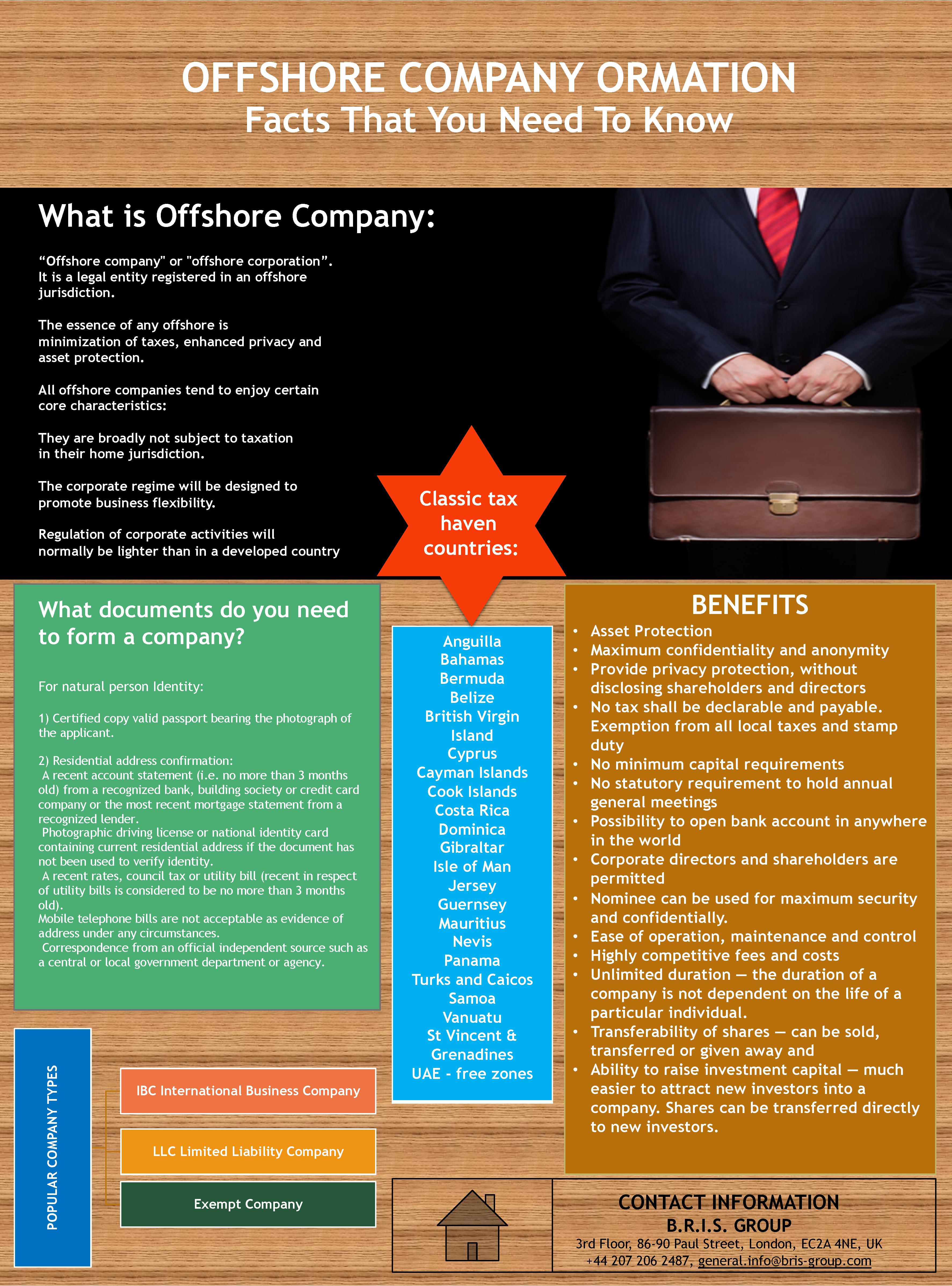

Many business-owners begin at this factor identifying the right jurisdiction for their firm. This will certainly depend on a number of various aspects, and also we can offer support and also advice throughout. Please see our section below for additional information. Picking a name. Picking a firm name isn't always as simple as you may assume.

This will certainly cover a series of details, such as: details of the shares you'll be issuing, the names of the company supervisor or supervisors, the names of the investors, the firm assistant (if you're intending to have one), and also what solutions you'll need, such as online offices, banking etc. The final part of the procedure is making a settlement and also there are a variety of ways to do this.

When picking the appropriate territory, a variety of elements should be taken into consideration. These consist of existing political circumstances, details conformity needs, plus the regulations and regulations of the country or state. You'll additionally require to consider the following (to name a few things): The nature of your company Where you live What continue reading this properties you'll be holding Our group are on hand to aid with: Making certain conformity when forming your firm Recognizing the local regulations and also legislations Banking Connecting with the needed organisations and solutions Business administration Annual renewal fees related to formation We'll help with every element of the company development procedure, regardless of the territory you're operating within.

Overseas company development has been made reliable and also simple with the GWS Group as we supply complete assistance in terms of technological appointment, legal consultation, tax advising services that makes the entire process of overseas company formation smooth, with no missteps or bottlenecks - offshore company formation. Today, a number of overseas companies that are running efficiently around the world have proceeded and availed our services and also have reaped abundant benefits in the due training course of time.

The Offshore Company Formation PDFs

An application is submitted to the Registrar of Companies with my link the asked for name. The duration for the authorization of the name is 4-7 business days. When the name index is approved, the Memorandum as well as Articles of Organization of the business are ready and also sent for enrollment to the Registrar of Firms along with the details regarding the police officers and also investors of the firm.

The minimal variety of supervisors is one, who can be either a private or a legal entity. Typically members of our firm are designated as nominee directors in order to execute the board meetings and also resolutions in Cyprus. By doing this management and control is made in Cyprus for tax obligation objectives.

Immigrants who do not want to appear as signed up shareholders might designate nominees to represent them as signed up investors, whilst the actual ownership will constantly reside the non-resident valuable proprietors of the shares (offshore company formation). Our company can supply nominee shareholders solutions upon demand. The presence of the firm assistant is needed by the Law.

Although the nationality of the assistant is unimportant it is recommended the secretary of the firm to be a citizen in Cyprus. The Cyprus Firm Regulation calls for the existence of the authorized workplace of the company on the region of Cyprus. The firm keeping the IBC supplies the services of a digital office with telephone, fax and all various other pertinent centers to assist in the management of the IBC.

Offshore Company Formation Things To Know Before You Buy

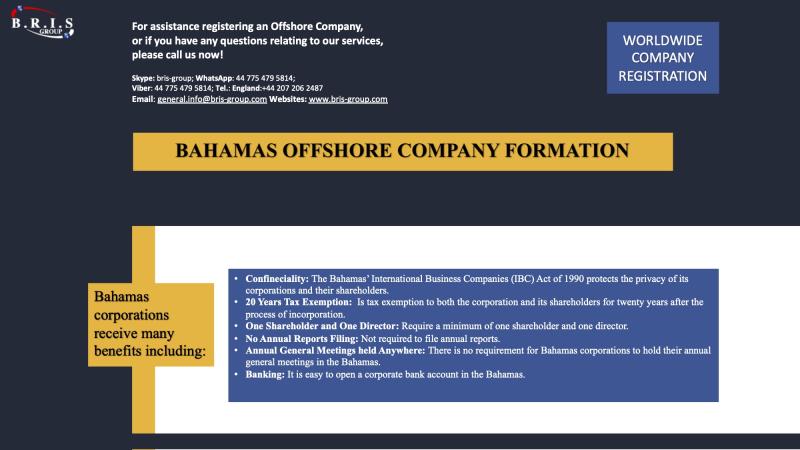

The supporter's workplace is typically stated as the signed up address of the company, where fax, telephone as well as various other facilities are supplied. With our company you can register a Belize business development, create an offshore Belize company as well as established Belize offshore savings account. Belize is an independent nation near Mexico with no funding gains tax obligation or estate tax.

Formation of a Belize IBC (international service firms) suggests no tax obligation would be paid on any type of earnings produced by the Belize firm from abroad task. Belize additionally has an unique tax obligation rule for individuals who are resident however not domiciled there: you only pay tax on earnings obtained in Belize.